Xem thêm

08.08.2022 02:01 PM

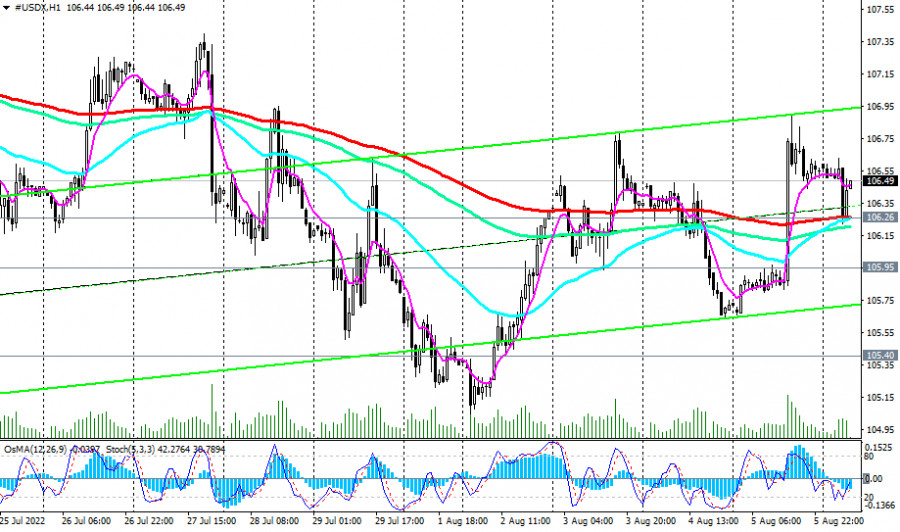

08.08.2022 02:01 PMAs of this writing, the dollar index (CFD #USDX) is trading near 106.50, above important short-term support levels 106.26 (200 EMA on the 1-hour chart), 105.95 (200 EMA on the 4-hour chart).

The breakdown of the levels 107.00, 107.50, 108.00 will be a confirmation signal for increasing long positions on the dollar.

In an alternative scenario and after the breakdown of the support levels 106.26, 105.95 DXY will fall to the support level of 105.40 (50 EMA and the lower line of the ascending channel on the daily CFD #USDX chart).

Given the continued positive dynamics of the dollar and the bullish trend of DXY, most likely, in the zone of support levels 105.40, 105.00, the dollar will receive a new impetus for growth, perhaps with the publication of fresh inflation indicators for the US on Wednesday.

Support levels: 106.26, 106.00, 105.95, 105.40, 105.00, 104.00, 103.75, 103.00, 102.20, 100.80, 100.00

Resistance levels: 107.00, 107.50, 108.00, 109.00

Trading Tips

Sell Stop 106.10. Stop-Loss 107.10. Take-Profit 106.00, 105.95, 105.40, 105.00, 104.00, 103.75, 103.00, 102.20, 100.80, 100.00

Buy Stop 107.10. Stop-Loss 106.10. Take-Profit 107.50, 108.00, 109.00, 110.00, 111.00

You have already liked this post today

*Phân tích thị trường được đăng tải ở đây có nghĩa là để gia tăng nhận thức của bạn, nhưng không đưa ra các chỉ dẫn để thực hiện một giao dịch.