Veja também

24.12.2025 10:09 AM

24.12.2025 10:09 AMStrong economic data and backing from the president—what more is needed to continue the S&P 500 rally? The broad market index marked a new record close amid an acceleration of US GDP to 4.3% in the third quarter. This result represents the best performance in two years and significantly exceeds Bloomberg analysts' expectations of 3.2%. The US economy is coping with a cooling labor market, which is beneficial for stocks.

According to Donald Trump, the stock indices' reaction to the impressive GDP figures could have been stronger. However, markets have recently responded to good news with skepticism, arguing that economic strength will lead to rising inflation and prompt the Fed to maintain interest rates. In reality, the new Federal Reserve chair will likely lower rates to reward investors for their success and support the stock market.

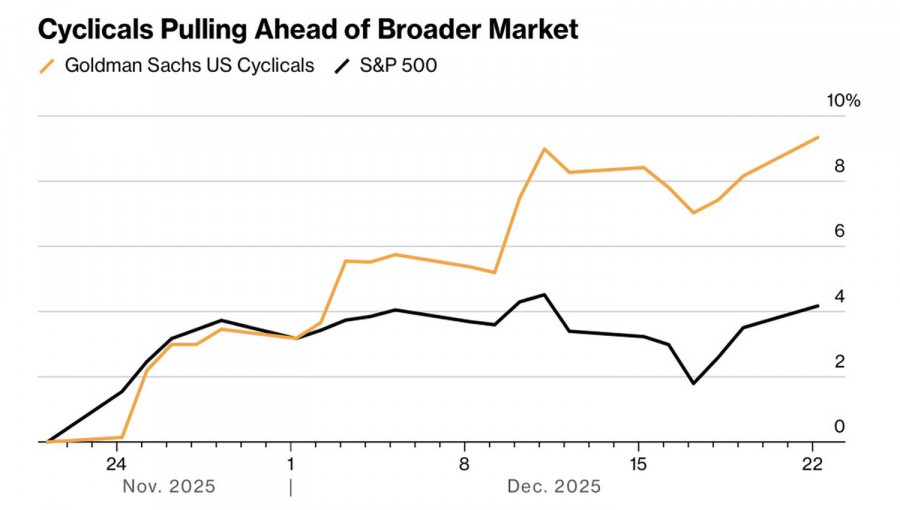

S&P 500 and Cyclical Stocks Index Dynamics

Presidential support is invaluable. However, without a strong economy, it is challenging to expect the S&P 500 to maintain its bullish trend for a fourth consecutive year. According to a survey of over sixty Bloomberg experts, US GDP is projected to expand by 2% or more in 2026, supported by cheap oil, which will also help slow inflation. This combination allows investors to rotate securities within their portfolios, replacing technology companies with cyclical stocks, which are currently outperforming the S&P 500. Investment advisors are particularly favoring JP Morgan, equipment manufacturer Caterpillar, as well as retailers Gap and Dollar Tree.

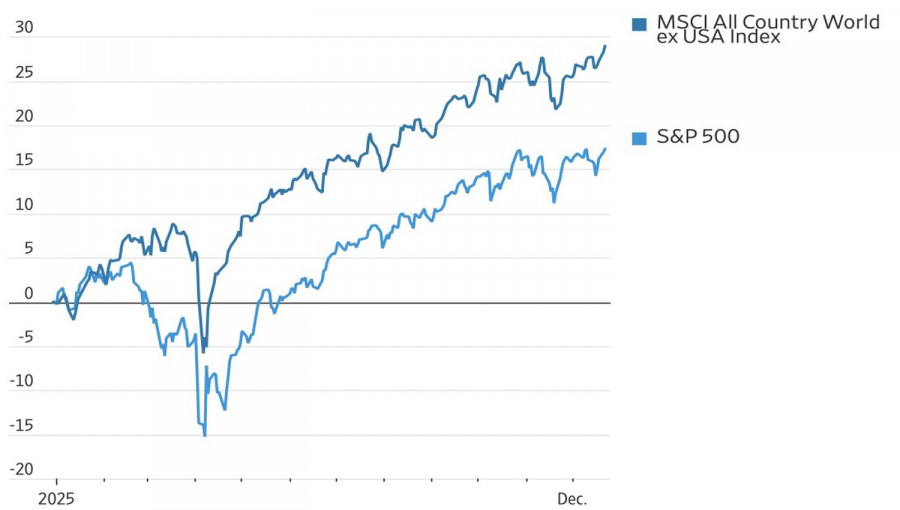

The current year has been significant for the MSCI All Country World ex-USA Index, which surged by 29%, outpacing the S&P 500 by 11.5 percentage points. If these numbers hold through the end of December, the gap will be the largest since 2009.

S&P 500 and Global Equity Markets Dynamics

In 2026, this divergence may widen even further. Germany, Japan, and China are not holding back on fiscal stimulus, and the conclusion of the armed conflict in Ukraine would reduce geopolitical risks and positively impact the European economy. The gradual increase in the Bank of Japan's overnight rate does not intimidate investors, as its monetary policy remains ultra-accommodative.

Next year, the S&P 500 will face stronger competition and will need to exert more effort to maintain its upward trend. However, does it really matter what will happen tomorrow? Today, the broad market index is enjoying the Christmas rally.

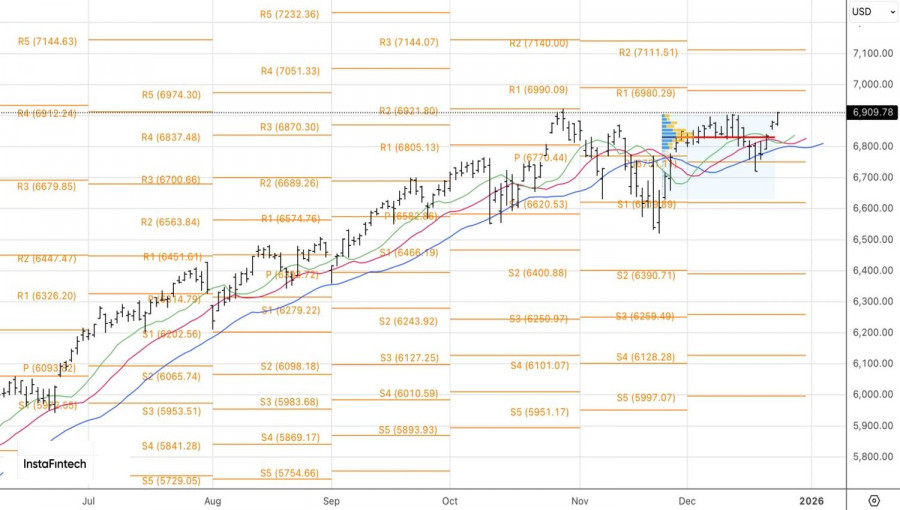

From a technical perspective, the daily chart shows that the S&P 500 has hit a new local high at 6,900. The October peak of 6,925 is within reach. A successful break above this level would pave the way for a continued upward trajectory toward the previously mentioned targets of 6,990 and 7,100. Traders are advised to maintain a focus on buying.You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.